Save Money: Budgeting for Teens Job or No Job

Share:

As teenagers, it can be hard to think about saving money for the future—especially when there are so many exciting things to spend money on. However, now is the best time for teenagers to learn to save and invest their money wisely. While there are many ways to save money as a teenager, here are some of the best ways to get started:

Key Takeaways

1. Start budgeting – Creating a budget is one of the best ways for teens to track their spending, set saving goals and stay on top of their finances.

2. Look for discounts – Take advantage of any discounts or student offers available to you as a teenager, from special deals at shops to free museum entry with student IDs.

3. Take on part-time work – Getting a job or taking on extra duties can help teenagers save money and gain valuable experience.

4. Cut down on unnecessary purchases – Make sure you make only necessary purchases, such as food and school supplies, rather than spending your money on things like clothes or entertainment that you don’t really need.

5. Invest in yourself – Saving money isn’t just about spending less, it’s also about investing in yourself and your future. Consider putting some of your savings into a retirement account or an education fund to ensure you have financial security later down the line.

6. Find ways to make money – Look for ways to make money through hobbies, such as selling handmade items or providing services like dog walking.

7. Spend your money wisely – Think carefully about how you’re spending your money – it could be best to save up for larger purchases like electronics or cars, rather than splurging on impulse buys.

Teenage Money Saving Tips:

1. Create a budget and track your spending.

One of the best ways to save money as a teenager is to create a budget for yourself and track how much you’re spending each month. This will help you stay on top of where your money is going, so you can make sure that you’re not spending too much.

2. Start a Savings Account.

Another great way to save money as a teenager is to start a savings account, which can help you build your financial future and teach you how to manage money responsibly. Even if you’re only able to set aside small amounts each month, this will add up over time, and you’ll be able to use the money for things like college tuition or a car.

3. Look for ways to make extra money.

Another way to save money as a teenager is to look for ways to make some extra cash on the side. You can do this by finding part-time jobs, tutoring your friends, or freelancing online. Any money you make can be put towards your savings account or used to pay for things like clothes or entertainment.

4. Start investing.

Investing is an excellent way to save money as a teenager and build wealth over time. You don’t need a lot of money to get started—many online brokers offer accounts with low minimum balances, so you can start small and learn how to invest before putting a lot of money in.

5. Keep track of your purchases, and think before you buy.

One of the best ways to save money as a teenager is to be mindful of your purchases and think twice before you buy something. Ask yourself if it’s something you really need or if it’s just an impulse buy—this will help make sure that your money isn’t going to waste.

6. Make a cash-match pact with your parents.

If you’ve already saved up some money, you can make a cash-match pact with your parents. This is an agreement where they will match any amount of money that you save—this way, you get to keep the extra money for yourself and still get rewarded for being responsible with your finances.

7. Use a coupon code extension for your browser.

If you’re shopping online, one of the best ways to save money as a teenager is to use a coupon code extension for your browser. This will help you find the best deals and discounts on all your purchases, so you can get the most bang for your buck.

8. List your sources of money, and prioritize them.

Lastly, one of the best ways to save money as a teenager is to list all your sources of income and prioritize them. This will help you make sure that you’re using your money wisely and not overspending.

9. Save Gift Money in a Bank Account.

If you receive gift money from family or friends, it’s best to put it in a bank account rather than spend it. This way, you can use the funds for important things like college tuition or investing in new business ventures.

10. Take advantage of student discounts.

If you’re a student, make sure to take advantage of all the discounts available to you. Many stores offer special student discounts or coupons, so be sure to check online or in-store for any deals that you may qualify for.

11. Educational Fund (529).

Another great way to save money as a teenager is to set up an Educational Fund (529). This allows you to put money away in an account specifically for education expenses, and it can be used at any college or university. Plus, the money you invest in these accounts can grow tax-free, so it’s a great way to save for the future.

5 reasons to save money as a teenager are:

1. To build a strong financial future.

2. To learn how to manage money responsibly.

3. To have extra funds for college tuition or other important expenses.

4. To take advantage of discounts available to students and other young people.

5. To set up an Educational Fund (529)

Income idea source for Teenagers :

1. Become a tutor for students: You can offer your services as a tutor to help students with their assignments, tests, and other schoolwork.

2. Pet sits or dog walk: You can offer to take care of people’s pets while they’re away. You could even walk the dogs for an extra bit of money.

3. Clean houses: You can offer to clean people’s houses or apartments for a fee.

4. Babysit: Many parents need someone to watch their children when they are away or busy, so offering your services as a babysitter is a great way to make money.

5. Sell things online: You can sell your old clothes, books, electronics, and more on websites like eBay or Craigslist for some extra cash.

Common question:

How much money should a 16-year-old have?

The amount of money you should have as a 16-year-old will depend on what your goals are. If you’re looking to save for college tuition or retirement, then it’s best to start with small amounts until you can build up more savings. But if you’re just looking for short-term spending money, then you should aim to have enough saved up for your goals. For example, if you’re saving money for a car, then set aside as much as you can each month. This will help make sure that you have the money when you need it.

What is the 50-30-20 rule?

The 50-30-20 rule is a basic budgeting guideline that helps you allocate your income in a way that best suits your goals and needs. According to the 50-30-20 rule, you should put 50% of your income towards essential expenses such as rent, food, bills, and other necessary costs. You should then put 30% of your income towards discretionary spending such as entertainment, hobbies and other activities. Finally, you should use the remaining 20% to save for future goals like retirement or college tuition. Following this rule will help ensure that you’re best using your money and staying on track with your financial goals.

How much money should a 14-year-old have saved?

The amount of money a 14-year-old should have saved will depend on their goals and financial situation. If they are just looking to save some spending money, they should aim to save enough for those short-term needs. Conversely, if they’re trying to build up long-term savings for college or retirement, then consistent saving will be necessary. It’s best to start small and add a little bit of money each month, as this will help build up savings over time. Setting goals and tracking progress can also help keep them motivated to save more.

How do you budget effectively?

Budgeting effectively involves setting clear financial goals and assessing your income and expenses to best allocate your money. Start by listing out all of your essential expenses such as rent, food, bills, etc. Then list out any discretionary spending like entertainment or hobbies. Once you have a clear picture of how much money you need for each category, it’s best to prioritize the essential items first before moving on to the discretionary items.

It’s best to also create a budget that allows you to save some money each month, as this will help ensure that you’re staying on track with your financial goals. Finally, tracking progress and revising the budget when needed can help keep you organized and motivated to stick with your plan.

How Much Should a Teenager Save from Paycheck?

The amount that a teenager should save from their paycheck will depend on their goals and financial situation. If they’re just looking to build up some short-term savings, then they should aim to save 10-15% of each paycheck. However, if they are looking to build up long-term savings for college or retirement, then it’s best to save a higher percentage. A good rule of thumb is to save at least 20% of each paycheck for long-term goals, and then use the remaining money for current expenses and short-term goals. This will help ensure that you’re best using your income to meet both your current and future needs.

How much money should I save each month?

The amount of money you should save each month will depend on your goals and financial situation. Start by assessing how much money you make each month after taxes. Then, determine how much of that money needs to go towards essential expenses like rent, food, bills, etc. Once those are accounted for, it’s best to set aside a portion of your income for savings. The amount you should save will depend on both your goals and financial situation, but even small amounts can add up over time.

By following these best ways to save money as a teenager, you’ll be well on your way to creating long-term financial success. With patience and consistency, saving money as a teenager can be both enjoyable and rewarding.

That covers the best ways to save money as a teenager. Hopefully, this article helped you understand how best to save your hard-earned income! Thanks for reading and best of luck on your financial journey!

Most Popular

What is Coffee Bloom and why does it happen?

20 Best Books Made Into Movies And TV Shows

Money Matters: 19 Best Personal Finance Books

Subscribe To Our Weekly Newsletter

Categories

Related Posts

Cute Girly College Ruled Composition Notebooks

Share: In a world dominated by digital tools and apps, the humble college-ruled composition notebook remains a steadfast ally in the quest for productivity. This timeless tool offers unparalleled benefits,

What is Coffee Bloom and why does it happen?

Share: When coffee is ground, the natural oils and aromatics are released. When these coffee grounds are combined with hot water, they create a “bloom” or foamy layer on top

20 Best Books Made Into Movies And TV Shows

Share: Nothing beats a great book-to-movie adaptation. Whether you’re a bookworm who loves to see their favorites brought to life on the silver screen, or a film buff looking for

Money Matters: 19 Best Personal Finance Books

Share: Financial planning is a key element of financial success. It can help you secure your financial future and meet any financial goals you may have. Whether you’re looking to

15 Of The Best Books that are Movies

Share: Do you ever find yourself drawn to Teen Books Made into Movies? Whether it’s the adventure of a classic novel or the modern-day drama of a contemporary story, movies

Women’s Guide to Growth: Best 11 Books

Share: Self-help books have become increasingly popular over the years, with more and more people looking for ways to improve their lives and reach their goals. With so many titles

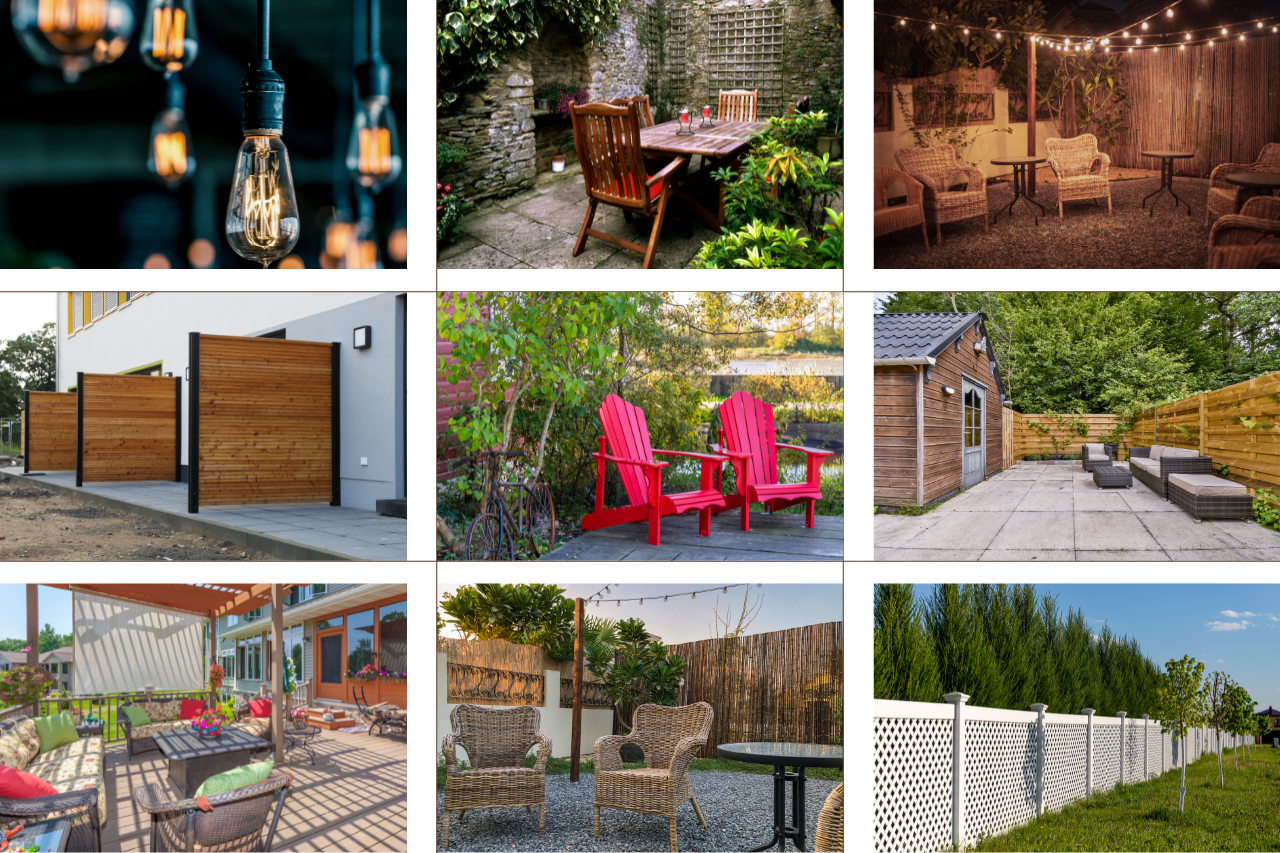

How to Make Patio More Private: Smart Patio Privacy Tips!

Share: In the realm of outdoor living, privacy stands as a paramount consideration, shaping our experiences and enhancing the enjoyment of our outdoor spaces. Within this article, we embark on

The Science of Slobber: What Your Dog’s Licks Really Mean

Share: As a devoted dog lover, few things in life compare to the joyous welcome of our furry companions, eagerly wagging their tails and showering us with affectionate licks upon